are electric cars tax deductible uk

There are three bands. Summary of Electric Car Tax Benefits In his March 2020 Budget Chancellor of the Exchequer Rishi Sunak confirmed that motorists buying electric cars would continue to benefit from the Plug-In Car Grant to 2022-2023 but it would reduce from 3500 to 3000 and cars costing 50000 or more would be excluded.

Russia Cancels Import Tax For Electric Cars In Hopes Of Enticing Drivers Bellona Org

In addition 130 relief is available for installing.

. If an electric car has CO2 with less than 50gkm of emissions can also qualify for 100 first-year capital allowances. By choosing an electric car your company can claim a 100 first-year allowance on the cost of the vehicle provided it is purchased new. Annual BIK tax payments are a percentage of that taxable value and depend on your income tax rate.

You can also check if your employee is eligible for tax relief. Electric cars are able to deduct entirely the cost of being sold from their pre-tax profits. For tax year 202021 the percentage used to calculate the benefit on fully electric cars with zero emissions was 0.

BMW 320d M Sport Auto. When the car is sold a balancing allowance can be claimed. To assist in the growth of electric and PHEV options HMRC have changed their approach to company car tax as set out below.

In March 2021 the government reduced the plug-in car grant PICG for new EVs from 3000 to 2500 with the threshold for qualifying purchases also falling from 50000 to 35000. Thanks to a 1 BiK rate for EVs announced by the Treasury for 202122 rising to 2 in 202223 a driver who swaps that 5 Series for a. Are electric cars tax-deductible in the UK.

Similar to the above we have broken down what this means for. For example a vehicle costing 36000 with CO2 levels of 32 gkm and an electric only range of between 30 and 39 miles will have a benefit rate of 12 in 2021-22 and be classified as having a taxable benefit of 4320. Some types of vehicle are exempt from vehicle tax.

In 202122 the BiK rate for these. This means its free to tax them. Find out whether you or your employee need to pay tax or National Insurance for charging an electric car.

So tax relief for leasing an electric car is given each year depending on the cost and business use contrasted with outright purchase which provides an initial and one-off tax deduction. This is an enhanced rate of capital allowances which would reduce your companys taxable profits for the. You can also check if your employee is eligible for tax relief.

For example the annual Benefit-in-Kind tax payable for a standard executive model such as a BMW 520i petrol with a circa-42000 P11D price and 145gkm CO2 emissions would be over 5500 for a 40 taxpayer. If your business purchases a new and unused electric car you get full tax relief in the year of purchase. Privately owned electric cars.

This page is also available in Welsh Cymraeg. The grant offers a discount of up to 3000 on the price of an electric car and 350 on the cost of installing a charger. There have also been reductions for electric hybrids depending on their electric-only range.

Because of the tax benefits of electric and hybrid cars this means Tom and the company can potentially save tax and National Insurance of 10103 overall. The tax rules for ultra low emission company cars are set to change from 6 April 2020 making the purchase of an electric vehicle potentially more attractive for a business. It came as a surprise to many when a scheme that aims to make electric vehicles EVs more affordable was cut.

The government sets this and it is 0 per cent for all fully electric cars in the 202021 tax year. If the car is leased solely for business purposes then VAT is fully deductible however if there is any personal use then only 50 VAT is deductible. As such company car drivers can save thousands of pounds a year simply by switching from a diesel model to an EV.

Use the company car tax calculator to calculate the company car tax due for any electric vehicle or. Where the employee uses his or her own electric car for business journeys the company can pay the normal tax-free mileage allowance to the individual of 45p per mile for the first 10000 miles driven in the year with additional business miles reimbursed at 25p per mile. Before this date electric vehicles costing more than 40000 were liable for an annual road-tax surcharge the first five times the tax was renewed.

You must tax your vehicle even if you do not have to pay. For the 202223 tax year the amount of tax you pay in each band is being increased the implications for electric cars is that you will pay 2 per cent tax rather than 1 per cent. As a result if your car is worth around 40000 you might receive a tax relief of 8400.

This compares very favourably to non-electric cars which receive only 6 570 or 18 1710 relief in year 1 depending on their CO 2 emissions. For cars with emissions below 50g CO2km the percentage will be based on the electric range of the vehicle and the registration date. This means a business can deduct the total cost from its pre-tax profits.

Fully electric vehicles can still create substantial savings for both employees and employers when taken via salary sacrifice. The rules were changed again in April 2020 albeit to a lesser degree. Road tax for zero emissions car is free too.

Are electric cars tax-deductible in the UK. But all electric cars are now exempt from all VED costs no matter their original list price. The key points to note from the new taxation regime is that a purely electric vehicle will have 0 Bik for 2020-21 1 2021-2022 2 2022-23.

Buy a 50000 car save 9500 in corporation tax. Financial Year 202122 sees pure-electric models rated at 1 for BIK and these rates only climb to 2 for FY 2223 and 2324. For many modern PHEVs there will be a 10-14 BiK banding so long as the.

For tax year 202122 this increased to 1 and then increases to 2 for years 202223 to 202425. As you saw above the key to BiK tax is the BiK band.

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Russia Cancels Import Tax For Electric Cars In Hopes Of Enticing Drivers Bellona Org

Why You Shouldn T Buy An Electric Vehicle For Your Family Road Trip Newfolks

2023 Is Supposed To Be The Year Of The Electric Vehicle Now Is The Time To Invest Protocol

The Tax Benefits Of Electric Vehicles Saffery Champness

Electric Cars Will Be Cheaper To Produce Than Fossil Fuel Vehicles By 2027 Automotive Industry The Guardian

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

Ev Tax Credit Plan Draws Ire From Non Union Toyota Tesla Bloomberg

The Uptake Of Plug In Hybrid Electric Vehicles In Europe S Company Car Fleets Trends And Policies International Council On Clean Transportation

Electric Car Incentives For Small Businesses Quickbooks Canada

Are Electric Cars Worth It Pros And Cons Metromile

How Do Electric Car Tax Credits Work Kelley Blue Book

Should I Buy Electric Cars Or Hybrid Now Automotive News

Electric Cars Will Be Cheaper To Produce Than Fossil Fuel Vehicles By 2027 Automotive Industry The Guardian

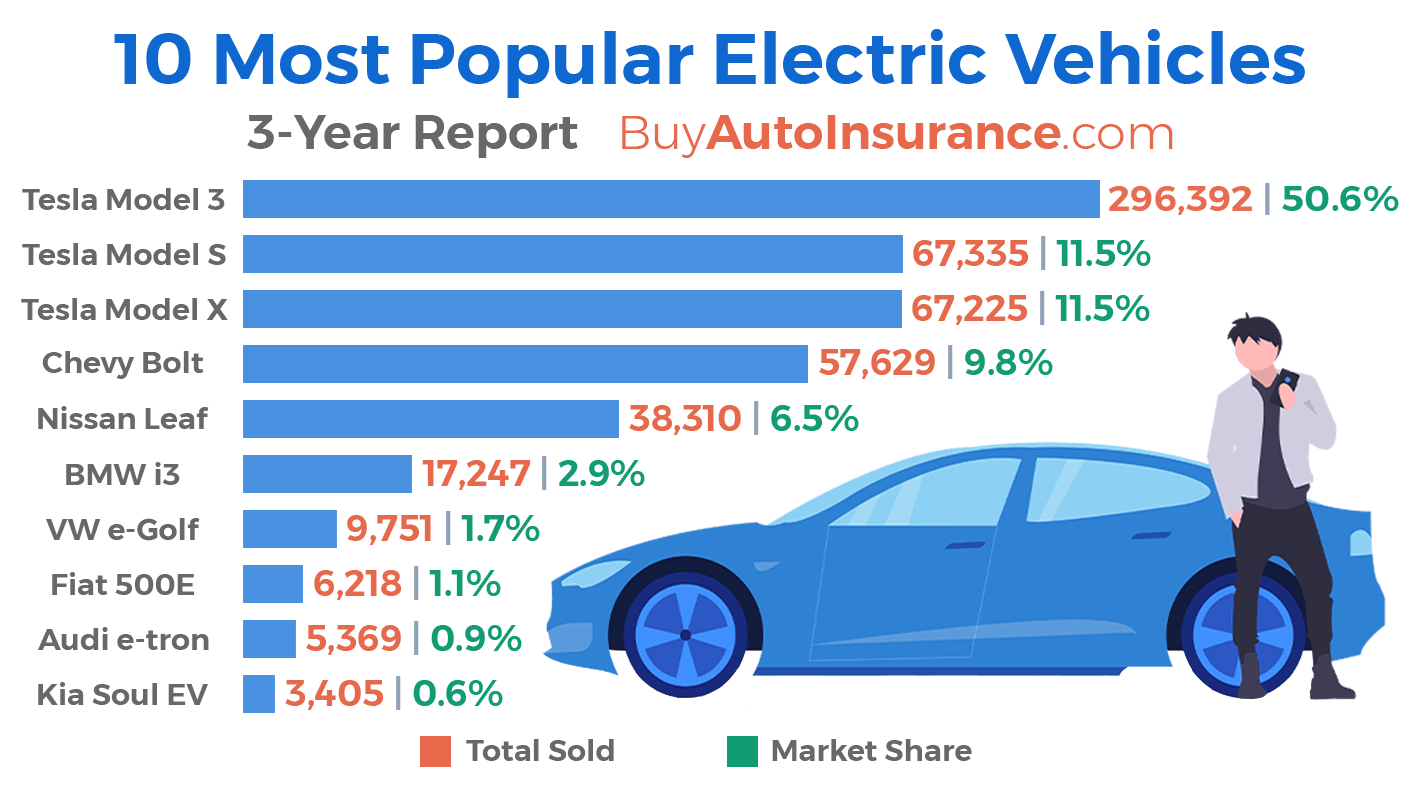

10 Most Popular Electric Vehicles 3 Year Trend 2021 Report

How To Decide An Electric Car Mileage Allowance I T E I

Electric Cars Looming Recycling Problem

Electric Cars Very Big Problem Continues To Loom

What Is The Morrison Government S Electric Cars Policy And Will It Actually Drive Take Up Electric Vehicles The Guardian